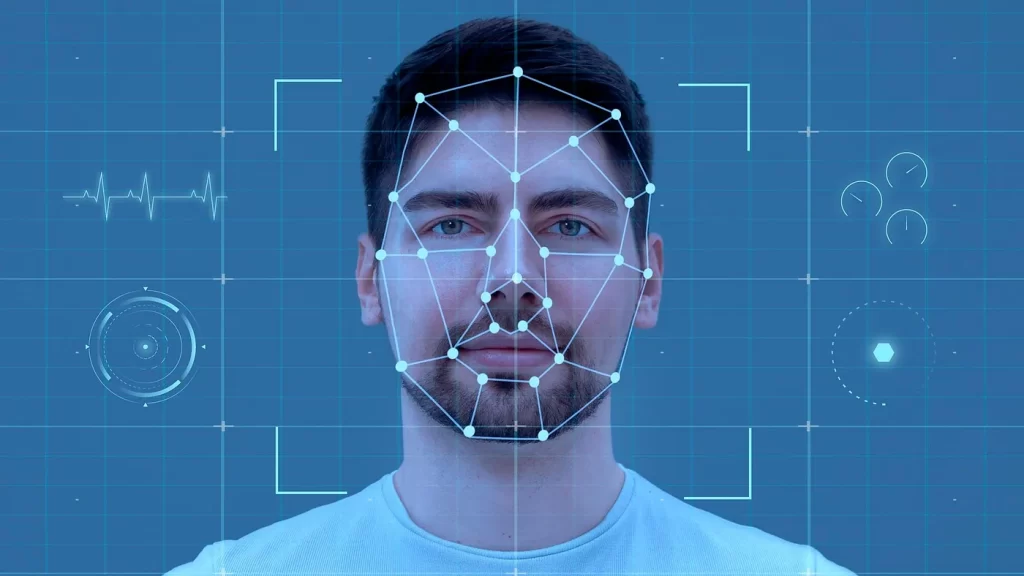

As we navigate the intricate landscape of finance, the year 2024 unfolds with a myriad of fintech innovations that promise to reshape the industry fundamentally. Fintech, a portmanteau of “financial technology,” has become synonymous with innovation and disruption, revolutionizing how we manage, invest, and transact in the digital era. In this comprehensive blog, we’ll explore the groundbreaking fintech trends that are set to dominate the stage in 2024. Decentralized Finance (DeFi): Decentralized Finance, or DeFi, stands at the forefront of fintech innovation in 2024. This paradigm shift involves leveraging blockchain technology to create a decentralized financial ecosystem that operates outside traditional banking systems. DeFi platforms facilitate peer-to-peer lending, borrowing, and trading without the need for intermediaries. Smart contracts on blockchain networks ensure transparency, security, and efficiency in financial transactions. As we move forward, the DeFi space is expected to mature, offering more sophisticated financial services while challenging the conventional norms of the finance industry. Central Bank Digital Currencies (CBDCs): Central Bank Digital Currencies are gaining prominence as central banks worldwide explore the digitization of national currencies. In 2024, CBDCs are not just theoretical concepts but tangible initiatives that aim to provide a secure and regulated digital alternative to physical cash. Countries like China have made significant strides in piloting CBDCs, aiming to enhance the efficiency of financial transactions, reduce costs, and ensure greater financial inclusion. The widespread adoption of CBDCs holds the potential to redefine the global monetary landscape. AI-Powered Personalization: Artificial Intelligence (AI) continues to be a driving force in fintech, particularly in the realm of personalization. In 2024, AI is set to transform the user experience by providing hyper-personalized financial services. Machine learning algorithms analyze vast datasets to understand user behaviors, preferences, and financial patterns. Fintech platforms leverage this data to offer tailored investment advice, customized budgeting tools, and personalized recommendations. AI-driven personalization not only enhances user satisfaction but also fosters a deeper connection between users and their financial platforms. Embedded Finance: Embedded finance is revolutionizing the way financial services are delivered by seamlessly integrating them into non-financial platforms. In 2024, we witness the expansion of embedded finance into various sectors, allowing users to access financial services without the need to switch between different applications. E-commerce websites, social media platforms, and even ride-sharing apps now offer embedded financial services such as payments, loans, and investments. This trend is breaking down traditional silos, creating a more interconnected digital ecosystem. Green Fintech: Sustainability takes center stage in 2024, and fintech is not exempt from this global shift towards environmental responsibility. Green fintech initiatives are emerging to address climate concerns and promote eco-friendly financial practices. This includes the development of digital currencies with lower carbon footprints, sustainable investment platforms that prioritize environmental, social, and governance (ESG) factors, and tools that encourage responsible spending and consumption. Fintech is becoming a driving force for positive environmental change, aligning financial activities with broader sustainability goals. Biometric Authentication: The quest for enhanced security in financial transactions has led to the widespread adoption of biometric authentication methods. In 2024, we see a surge in the use of biometrics, such as facial recognition, fingerprint scans, and voice recognition, to verify user identities. These advanced authentication methods provide an extra layer of security against fraud and unauthorized access. As fintech platforms prioritize user safety, biometric authentication is becoming integral to ensuring secure and convenient financial transactions. The year 2024 marks an important turning point in the growth of fintech when creativity and technology combine to reshape the financial environment. From the decentralized revolution of DeFi to the digitization of national currencies via CBDCs, the fintech industry is undergoing transformational change. AI-powered personalization, embedded finance, green fintech efforts, and biometric authentication all work towards a future in which financial services are not just technologically advanced but also sustainable, secure, and seamlessly interwoven into our daily lives. As we welcome the advancements in fintech, it’s crucial to acknowledge their profound impact on money management. Heading into 2024, the future of financial technology promises ongoing empowerment, bridging financial divides, and fostering a more inclusive and sustainable global economy. Leading this transformative journey is Wibmo, a key player in fintech, utilizing innovative technologies. With our robust payment security and digital payment services, we play a pivotal role in seamlessly integrating financial services, ensuring heightened security and transaction efficiency. In this era of significant shifts in the financial industry, we are happy to be able help banks and fintech firms in reshaping the landscape of finance. 2024 Trends, 2024 Trens, Digital Finance, Financial Services, Fintech, Fintech Trend