The digital era has witnessed remarkable advancements in technology, especially in the realm of online payments. One such transformative innovation that has reshaped the landscape of identity verification and authentication is facial recognition. This blog delves into the evolution, applications, benefits, challenges, and the profound impact of facial recognition on the world of online payments.

Evolution of Facial Recognition in Online Payments:

The journey of facial recognition in online payments traces back to its early stages as a biometric authentication method. Traditionally, online transactions relied on conventional methods like passwords and PINs, which presented challenges such as security vulnerabilities, user inconvenience, and the risk of unauthorized access. Facial recognition emerged as a solution to these challenges, offering a unique and secure way to verify identities.

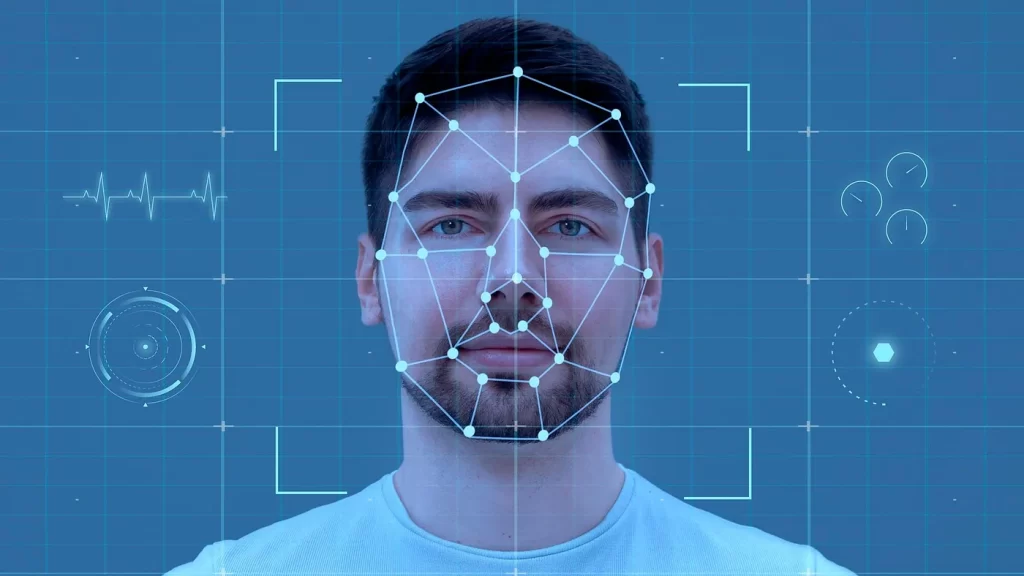

In its nascent phase, facial recognition technology focused on basic facial feature detection. However, rapid advancements in artificial intelligence (AI) and deep learning revolutionized facial recognition algorithms. These sophisticated algorithms could now analyze intricate facial contours, landmarks, and unique patterns, making facial recognition a reliable and efficient method for identity verification in online payments.

Applications of Facial Recognition in Online Payments:

- Biometric Authentication: Facial recognition serves as a robust biometric authentication method for online payments. Users can securely authenticate transactions by simply looking at their device’s camera, eliminating the need for passwords or PINs.

- Secure Login and Transaction Authorization: Online banking and payment applications leverage facial recognition to enhance security during login and transaction authorization. Users can seamlessly access their accounts and authorize payments through a quick facial scan.

- E-commerce Verification: Facial recognition is integrated into e-commerce platforms for user authentication during the checkout process. This ensures that only authorized users can make purchases, reducing the risk of fraudulent transactions.

- Mobile Wallets and Digital Payments: Mobile wallets and digital payment apps incorporate facial recognition to facilitate secure transactions. Users can link their facial biometrics to their payment accounts, adding an extra layer of security to mobile-based payments.

- Fraud Prevention: Facial recognition contributes to fraud prevention by adding a layer of identity verification that is difficult to replicate. This is particularly valuable in mitigating the risks associated with unauthorized access and fraudulent transactions.

Benefits of Facial Recognition in Online Payments:

- Enhanced Security: Facial recognition significantly enhances the security of online payments by providing a unique and biometrically secure method of identity verification. This reduces the risk of unauthorized access and identity fraud.

- User-Friendly Authentication: Compared to traditional authentication methods, facial recognition offers a user-friendly experience. Users can complete transactions with a simple facial scan, eliminating the need to remember complex passwords.

- Convenience and Speed: The speed at which facial recognition systems operate contributes to the overall convenience of online payments. Quick and non-intrusive, the technology streamlines the authentication process for users.

- Reduced Dependency on Passwords: Facial recognition reduces the dependency on passwords or PINs, addressing the challenges of password fatigue and the potential for security breaches due to weak passwords.

- Seamless Integration: Facial recognition seamlessly integrates into existing online payment platforms and applications. Its compatibility with mobile devices and web interfaces ensures a smooth and consistent user experience.

Challenges and Considerations:

- Privacy Concerns: The widespread adoption of facial recognition in online payments raises concerns about privacy. Users may worry about the collection and storage of facial data, emphasizing the need for transparent policies and ethical practices.

- Accuracy and Bias: Ensuring the accuracy of facial recognition systems, especially across diverse demographics, remains a challenge. Developers must continuously address biases in algorithms to ensure fair and reliable authentication.

- Security Vulnerabilities: Facial recognition systems are not immune to security vulnerabilities. Safeguarding against hacking attempts and unauthorized access to facial data is crucial to maintaining the integrity of online payment security.

- Regulatory Compliance: The evolving regulatory landscape surrounding facial recognition technology requires adherence to ethical and legal standards. Striking a balance between innovation and compliance is essential for responsible deployment.

Impact on User Experience and Security:

- Enhancing Trust and Confidence: Facial recognition contributes to building trust and confidence among users by providing a secure and user-friendly authentication method. This is particularly crucial in the competitive online payment market.

- Reducing Friction in Transactions: The seamless and quick nature of facial recognition reduces friction in the transaction process. Users can complete payments effortlessly, contributing to a positive and efficient online shopping experience.

- Addressing Security Concerns: By offering a biometrically secure method of identity verification, facial recognition addresses security concerns associated with traditional authentication methods. This reassures users about the safety of their financial transactions.

- Adapting to Changing Consumer Behavior: As consumers increasingly seek convenient and secure payment methods, facial recognition aligns with changing preferences. Its integration into various devices and platforms caters to the evolving needs of tech-savvy consumers.

Future Trends and Innovations:

- Multimodal Biometrics: The future of facial recognition in online payments may witness the integration of multimodal biometrics, combining facial recognition with other biometric methods for enhanced security.

- Continuous Authentication: Innovations in continuous authentication using facial recognition may become more prevalent. This involves ongoing verification during a session, adding an extra layer of security.

- Blockchain Integration: Blockchain technology may be integrated with facial recognition for enhanced data security. Decentralized identity verification could mitigate concerns related to centralized storage of facial data.

- Augmented Reality (AR) Enhancements: Augmented reality features may enhance facial recognition experiences, providing interactive and engaging authentication methods for users.